HReasily partners Visa to help SMEs manage payment of employee salaries.

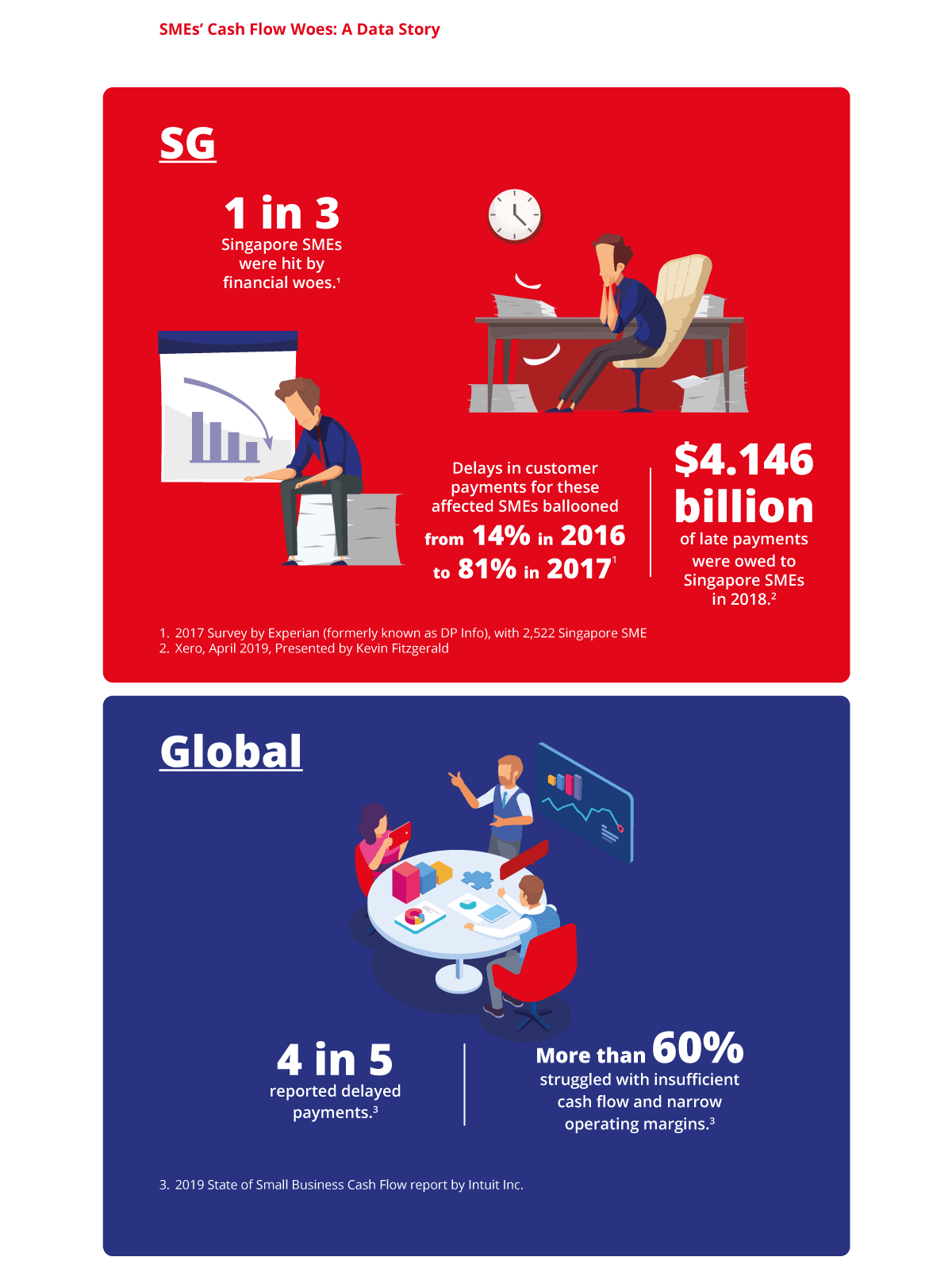

Of the challenges specific to small to medium enterprises, cash flow crunch ranks chief among them.

Regionally, leaders in financial and accounting roles note that even when incomings register on the books, calling them in takes longer than the global average, saddling them with paying salaries and other costs before goods and services are converted to cash. This, even for businesses that are doing a roaring trade.

Enterprises that are small to medium in size, which operate on modest margins, can be felled by such delays, observed Ms Chew Mok Lee, assistant chief executive of statutory board SPRING Singapore (now Enterprise Singapore after merging with International Enterprise Singapore in April 2018). “You may have sales, but if you can’t collect, it’s a big issue.”

Similar pains are echoed among SMEs in Singapore, Malaysia and Thailand.

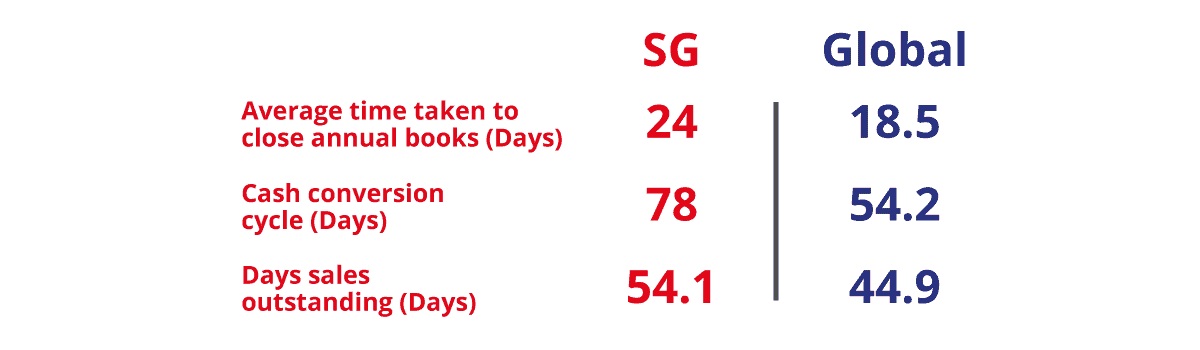

In Singapore, businesses reported averages of about 24 days to close their annual books, 5.5 days longer than the average of 18.5 days among a global peer group of 1,541 organisations from North America, Asia Pacific, EMEA (Europe, the Middle East and Africa) and LAC (Latin America and Caribbean). These 2015 statistics, collated by the latest Institute of Singapore Chartered Accountants (ISCA)-SAP Productivity Scorecard & Benchmarking Survey Report, represent professional accountants in businesses, operating as their chief financial officers, finance directors or equivalent, or 91.3% of respondents.

Singapore businesses took 54.1 days to collect payment, 9.2 more days than the global average. They also experienced a longer cash-conversion cycles of up to 78 days to convert inventory (services or goods) into cash earnings — nearly a month longer than their global peers’ average of 54.2 days.

In Malaysia, Bank Negara’s 2018 annual report found that about a third of 1,529 SMEs faced constraints such as restricted cash flows. Another study, by the Malaysia SME Media Group and INTI International University and Colleges, found that late payments affected 73% of the 2,000 Malaysian SMEs, who took an average of 47 days to receive payments.

In Thailand, constricted cash flow makes SMEs vulnerable to multiple risks, said Mr Noppong Teeravorn, president of the Federation of Thai SME Association. “It limits their ability to expand and their ability to survive,” he said, speaking on behalf of the collective, which represents 130 SME-related associations in Bangkok and its surrounding areas, a total of about 14,000 companies.

An Elegant Solution For SMEs

To ease the pain, HReasily has partnered with Visa to enable SMEs to pay their employees’ salaries with a business credit card.

“Global research suggests that the majority of SMEs would like to make more payments onto a credit card,” said Mr Matt Baker, Head of Small Business, Asia Pacific, Visa. Easing the pain of paying employee salaries ahead of receiving payments from tardy customers is an advantage for all SMEs, which in Singapore alone, account for up to 99% of 264,000 enterprises.

“Supporting the payment of employee salaries via credit card provides an invaluable lifeline for businesses when cash flow is tight,” Mr Baker said. “After all, paying employees on time is an essential element to running and growing a successful business — if salaries aren’t paid on time, there’s a high chance employees will become disengaged and seek alternative employment.”

“HReasily is a leading provider of HR solutions to SMEs and aligns with Visa’s vision to be the best way to pay and be paid, for everyone. Any tool that SMEs can adopt to save time and digitalise processes will be highly advantageous for their business.”

HReasily makes payday stress-free for business owners. With our integrated payroll module, businesses can put the recurring high-cost payments of employee salaries on their credit card. This frees up SMEs’ working capital and provides a critical interest-free extension of up to 55 days while they await customer payments.

Credit card payments on our platform also directly integrate into our payroll module for secure and seamless transactions. To give further peace of mind, Visa business cards have the capability for card controls, meaning the cardholder can toggle on and off particular features or set transaction limits. For example, a card can be disabled for overseas transactions if the cardholder won’t be travelling internationally.

By paying employee salaries via credit card, businesses can ensure that they:

- Pay staff on time

- Extend their working capital by up to 55 days, interest-free

- Keep cash on hand to cover emergencies

- Have larger margins to drive business innovations

- Grow their business

To learn more about the option to pay employee salaries via credit card, please contact us at [email protected].