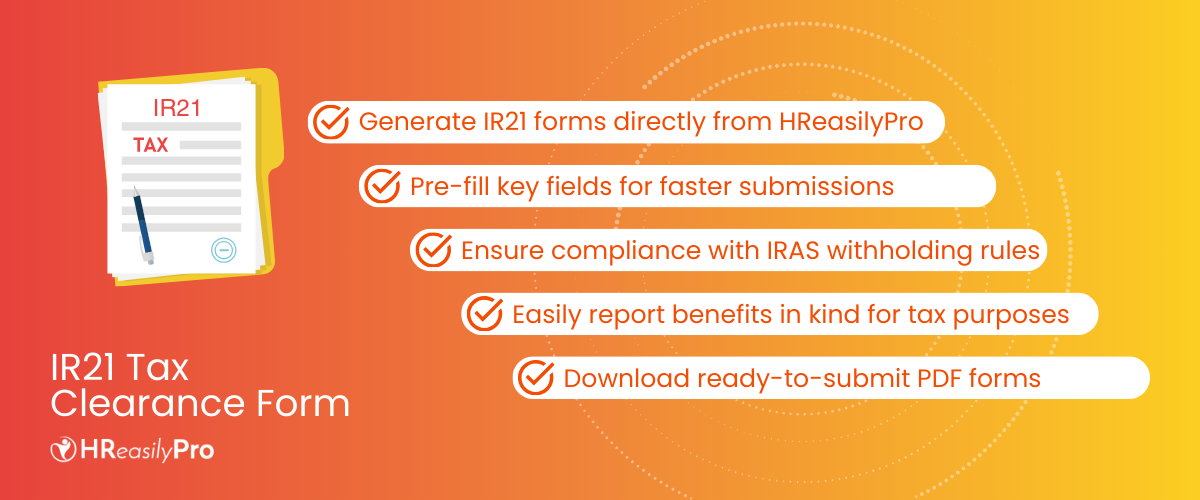

We are excited to introduce a powerful new feature within HReasilyPro designed to streamline the tax clearance process for employers in Singapore. With the latest update, HR teams can now easily generate the IR21 Tax Clearance Form directly as a webform, ensuring compliance and accuracy with Singapore tax regulations.

Effortlessly Manage Your IR21 Submissions

HReasilyPro allows HR teams to efficiently update IR21 information for any SPR (Singapore Permanent Resident) or FIN (Foreign Identification Number) employees who have resigned, are going on an overseas assignment, or are planning to leave Singapore for more than three months. With just a few clicks, users can input the necessary details and generate a PDF version of the IR21 form, ready for submission to the Inland Revenue Authority of Singapore (IRAS).

Key Features:

- Convenient Webform Generation:

Users can input all relevant employee details directly within HReasilyPro, including automatic pre-filling of certain fields to minimise data entry. Any mandatory fields required by IRAS are built into the system, ensuring a smooth and compliant submission process. - Pre-filled Information:

To simplify the process, HReasilyPro pre-fills certain data fields directly from the employee’s profile and payroll records. However, users should be aware that any benefits in kind—such as rent paid by the company for housing, relocation benefits, or school fees—will need to be entered manually if they aren’t included in the payroll system. - Compliance with Tax Regulations:

Employers are required to withhold any outstanding payments to employees until IRAS tax clearance has been granted. HReasilyPro helps ensure compliance with these rules, allowing you to hold back unpaid salaries or other due amounts while the tax clearance process is ongoing. - Comprehensive Benefits Reporting:

HReasilyPro ensures that all benefits in kind and taxable stock options, such as Employee Share Ownership Plans (ESOPs), are reported for tax purposes. The available fields in HReasilyPro match exactly with the IR21 form, reducing the risk of errors or missing information.

What Is Form IR21?

The IR21 Tax Clearance Form is required when a non-Singapore citizen employee ceases employment in Singapore, is sent on an overseas posting, or plans to leave Singapore for more than three months. Employers are responsible for filing this form with IRAS and withholding all monies due to the employee for tax clearance purposes. This rule applies to all work pass holders, including those holding a Personalised Employment Pass (PEP).

Ready to Streamline Your IR21 Process with HReasily?

Enhance your tax clearance management with our new IR21 feature. Effortlessly generate and submit your IR21 forms directly within HReasilyPro, saving you time and ensuring compliance. Try HReasilyPro for 30 days—completely free!

Need assistance? We’re here for you. Email us at [email protected] or book a demo session today. [BOOK A DEMO]

Our team is ready to guide you through utilising this new feature, ensuring a smooth and efficient experience tailored to your business needs. Let us help you make tax clearance easier and more reliable.