Managing payroll in today’s dynamic business landscape can be both intricate and time-consuming. To simplify this essential process, many companies are adopting payroll software. With its ability to automate payroll tasks, this software enables businesses to save time, minimise errors, and ensure adherence to tax regulations. Nonetheless, the vast array of options in the market can make selecting the ideal payroll software a challenging endeavour.

This article aims to examine the crucial features and considerations to bear in mind when choosing payroll software.

What are the key features and considerations to keep in mind when selecting payroll software?

1. Payroll Processing Capabilities

The primary function of any payroll software is to process employee payments accurately and efficiently. Therefore, it is crucial to evaluate the payroll processing capabilities of the software you are considering. Look for features such as automatic calculation of wages, taxes, and deductions, as well as support for various payment methods like direct deposit or physical checks. The software should also handle different pay frequencies, bonuses, and overtime calculations. Additionally, ensure that the software is equipped to handle local tax regulations and generate accurate tax forms and reports.

2. Employee Self-Service Portal

An employee self-service portal is an essential feature to consider when choosing payroll software. This portal empowers employees to access and manage their payroll-related information independently. With a self-service portal, employees can view their salary slip, tax documents, and other relevant information. They can also update their personal details, such as address or bank account information, reducing the administrative burden on HR teams. A self-service portal not only enhances employee satisfaction but also promotes transparency and accountability within the organisation.

3. Integration with HR and Accounting Systems

For seamless and efficient payroll management, it is crucial to select software that integrates well with your existing HR and accounting systems. Integration eliminates the need for manual data entry and reduces the chances of errors or discrepancies. HReasily payroll software is able to synchronise employee data, such as hours worked and employee details. Additionally, integration with accounting software ensures that payroll data flows smoothly into your financial records, simplifying reconciliation and financial reporting processes. Check out HReasily integration with QuickBooks.

4. Compliance and Security

Payroll processing involves sensitive employee information and must adhere to strict legal and security standards. When evaluating payroll software options, consider the compliance features offered by the software provider. Ensure that the software complies with labour laws, tax regulations, and data protection requirements specific to your jurisdiction. Look for features like automated tax updates, compliance reporting, and secure data storage. Additionally, assess the software’s security measures, such as data encryption, access controls, and regular backups, to protect sensitive payroll information from unauthorised access or loss.

5. Scalability and Flexibility

As your business grows, your payroll requirements will evolve. It is essential to select payroll software that can scale alongside your organisation. Consider the software’s ability to handle increasing employee numbers, different employee classifications (e.g., full-time, part-time, contractors), and multiple company locations or entities. Additionally, assess the software’s flexibility to accommodate custom pay structures, benefits, and deduction plans unique to your organisation. The software should offer configurable options that align with your specific payroll policies and workflows.

6. User-Friendly Interface and Support

A user-friendly interface plays a vital role in ensuring efficient payroll management. Look for software that offers an intuitive and easy-to-navigate interface, reducing the learning curve for your HR and payroll teams. Additionally, consider the availability of user training resources and ongoing customer support from the software provider. Responsive customer support can help resolve any issues promptly and provide guidance when needed.

Choosing the appropriate payroll software is of utmost importance for every organisation. By taking into account the aforementioned key features and considerations, businesses can ensure efficient payroll processes, minimise errors, and comply with tax regulations.

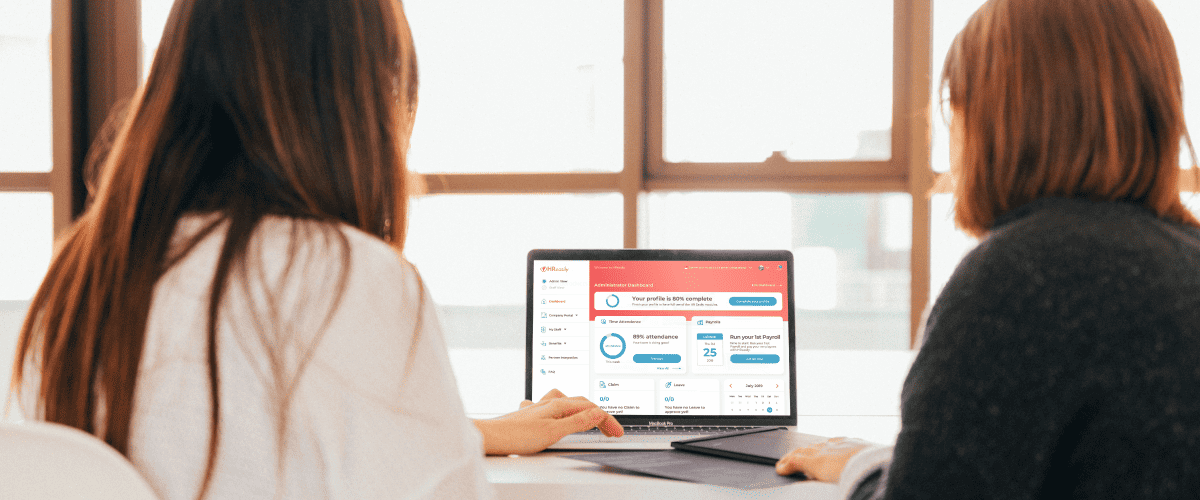

Explore the software and personally try out its interface before you commit. HReasily Trial is available for your usage and to support you in setting a standard of comparison.

In this competitive landscape, HReasily software shines as a top-notch option, providing an extensive range of features and outstanding support. Make a well-informed decision and empower your organisation with the capabilities of HReasily software, enabling streamlined and precise payroll management.

HReasily Software: The Optimal Choice for Payroll Management

In the expansive realm of HRMS payroll software, HReasily stands out as an exceptional solution. HReasily presents a comprehensive array of features that meet the key considerations discussed earlier. Its robust payroll processing capabilities automate intricate calculations, guaranteeing accurate and prompt payments. The user-friendly employee self-service portal empowers individuals to independently manage their payroll information, fostering efficiency and engagement. HReasily seamlessly integrates with diverse accounting systems, alleviating manual tasks and enhancing data precision.

Furthermore, HReasily places significant emphasis on compliance and security, offering extensive measures to safeguard sensitive payroll data and ensure adherence to legal requirements. The software exhibits scalability and adaptability, accommodating the evolving demands of growing enterprises. With its intuitive interface and dedicated customer support, HReasily provides an effortless experience for HR and payroll teams alike.

Try HReasily with 30-day FREE trial today: SIGN UP

Prefer a personalised discussion? Speak to us at [email protected]